When dealing with personal finances, a critical skill often gets overlooked in the digital age – chequebook balancing. Understanding “how long does it take a check to clear” is part of this financial prowess. Let’s delve into the art of chequebook balancing and why it’s vital for financial stability.

1. The Importance of Balancing Your Checkbook

Balancing a chequebook is much like maintaining the balance of a seesaw. It’s all about ensuring that your account (debits) money matches what you believe is being spent. Similar to a well-maintained seesaw offering a smooth ride, a properly balanced chequebook ensures financial fluidity.

This technique can help avoid overdrafts, spot fraud, and provide a realistic picture of your financial health. By preventing unexpected surprises, you can plan for the future with confidence. Furthermore, it instils a discipline of mindfulness towards your financial habits, encouraging responsible spending and saving.

2. Understanding How Long It Takes a Check to Clear

A crucial part of balancing a chequebook involves understanding how long a check takes to clear. Like a basketball passing through a hoop, this process involves several steps before the funds become available in your account.

On average, it can take anywhere from two to five business days for a check to clear, but this time can vary depending on the bank and the type of check. Just like a basketball game involves understanding the game’s rules, balancing your chequebook involves knowing your bank’s clearing times. Recognizing this can prevent misunderstandings about your account balance, further facilitating smoother financial operations.

3. Tracking Your Transactions

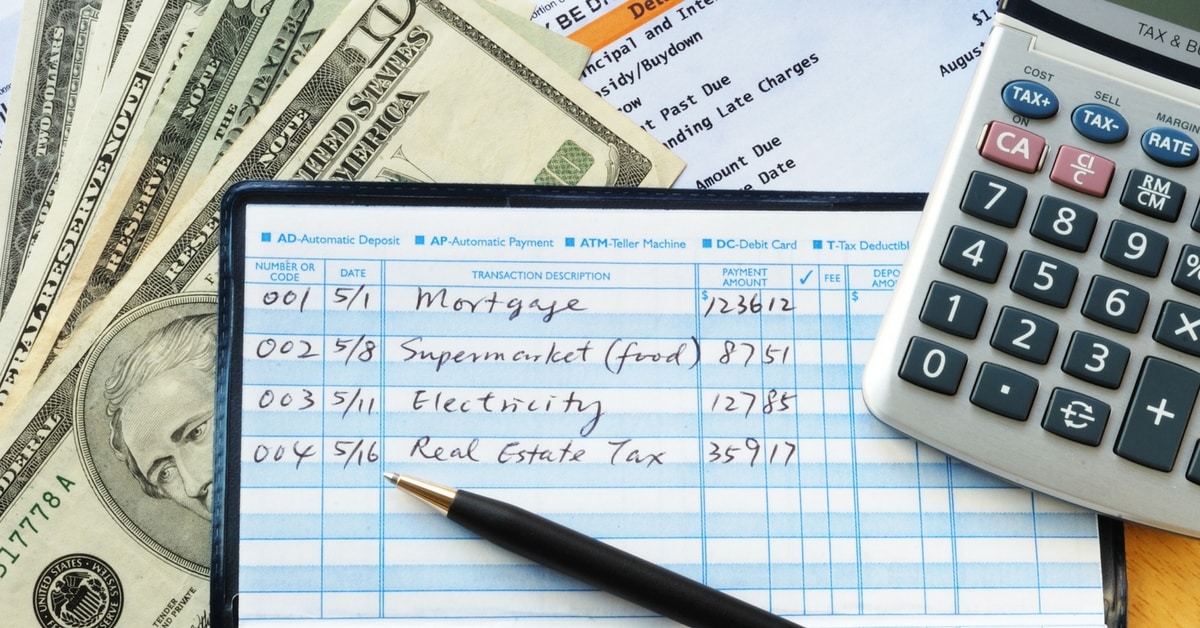

Just as a successful basketball team keeps track of its plays, successful chequebook balancing requires keeping track of all your transactions. This process involves recording all your written checks, deposits, withdrawals, and bank fees. Keeping track of pending checks that have not yet cleared can be beneficial to avoid mistakenly overspending.

4. Regularly Comparing Your Records with Your Bank Statement

Imagine a basketball coach comparing his game plan to actual game performance. Similarly, regularly comparing your chequebook records to your bank statement is crucial. This practice, known as reconciling your chequebook, can help identify any discrepancies, such as unexpected fees or errors, either on your or the bank’s part.

This comparison provides the opportunity for error correction and insight into your financial health. Think of it as a reality check, a way of validating your financial tracking against the official bank records.

5. Mastering the Art of Checkbook Balancing

Mastering the art of chequebook balancing involves discipline, regularity, and attention to detail. You can maintain an accurate understanding of your financial standing by consistently recording your transactions, understanding the clearing process, and regularly reconciling your records. As an industry leader, SoFi reinforces the importance of these skills. Their website states, “Each banking app will have a different process for uploading checks, but most are simple and fast.”

Balancing your chequebook might seem dated in today’s digital banking age. Still, it remains an essential tool for managing personal finances effectively. Like a time-tested basketball strategy, it’s a skill that can provide significant benefits when mastered, leading to improved financial stability and peace of mind.

Leave a Reply