Supply@ME Capital PLC (LSE: SYME) is a financial technology vendor platform that offers an alternative way for companies to raise capital by leveraging their own inventory. Manufacturing and trade businesses can strengthen their cashflow and capital positions through a ‘true sale’ of their warehouse holdings to special purpose vehicles incorporated by SYME, which also creates a new asset class for investors.

We forecast 60% YoY net profit growth in FY21 based on 23% YoY revenue growth and margin improvement from new markets and a strong pipeline. We believe SYME’s shares are undervalued at the current range of £0.50-£0.60 and would expect more movement in the £2.00 to £2.50 bucket to Q12021.

Lending disruptor

SYME is not a traditional lender, despite fulfilling many of the middleman duties. As a pure service provider, SYME matches capital suppliers with companies in need of liquidity. The range of industries it serves is almost unlimited. The exclusive model allows special purpose vehicles (stock companies), incorporated by Supply@ME to purchase the inventory, which is then leased back to the company, never leaving the warehouse.

As a pure play digital lender, or a stock-loan lender, SYME is up against strong incumbents, with little ability to raise the kinds of sums required to make a dent in the aerospace or chemicals market. Where SYME differs is its role as a straightforward service provider, removing the focus on its own balance sheet.

Revolutionary platform

SYME’s fintech service boasts multiple risk analysis methodologies and entirely transparent, cutting-edge blockchain to manage transactions. SYME is one of the first fintechs to leverage blockchain out of the lab into a dynamic, real-world use case. Not only is the back-end secure and tamper-proof, the digitized inventory tracker can be accessed in real-time.

Blockchain technology and the emerging smart contracts space are upending traditional ownership transfer processes. The entirely digital SYME framework renders a digital certificate of a physical inventory, allowing for immediate transfer of funds to the client in return. The need for physical transportation of property or access to grounds is eliminated, and the ownership monitoring of the inventory is enabled through SYME’s blockchain. A permanent record of transactions is created, allowing SYME to monitor the progress of the inventory as it is sold, with a series of algorithms monitoring for breaches or losses. SYME’s secure system guards against risk, providing security for both sides of the transaction.

Supply chain efficiency

SYME intends to drive future growth by targeting food retail and wholesale, and other verticals with notoriously lengthy supply chain hold ups and enhancing its software products to deliver more value to existing verticals.

Global supply chains are in disarray over the prolonged impact of the coronavirus crisis, with a second wave looming and no end to the disturbance in sight. One of the big decisions facing supply chain executives today is balancing investments between low severity, highly probable events and the black swan occurrences of high severity, low probability events, like Covid-19. Currently, investments made in the former heavily outweigh those made in the latter because most risk events like natural disasters share an important characteristic – a similarity with past events.

Historical demand and supply data, previous responses and recovery roadmaps all feature, real-world-tested risk management protocols, and reliable disruption action plans. Coronavirus has wiped the slate clean, there is no data, and firms are now stuck trying to balance investments with little knowledge of the horizon. Immediate access to working capital becomes critical for swathes of industries, and particularly those that hold significant concentrations of inventories, such as manufacturers of personal protective equipment (PPE). The company needs its inventory ready to sell at minimal notice, but must also have cash allocated for further purchasing inventory. When tied up, there is little access to the necessary liquidity. SYME resolves this problem, and a further pandemic could trigger an upward stock price catalyst, in our view.

Lean structure and strong cashflows

SYME has an exceptionally strong product and software development team alongside its core business development team entrenched in key markets. The recent move to London helped solidify SYME’s position as a bold start-up with an attractive proposition, given the attention foisted on it by London’s lenders looking for value amid market turbulence. For FY21, we expect 60% YoY core net profit growth driven by 23% YoY revenue growth and margin improvements from entering new markets and further expansion in the ME and US. Growth by M&A is also possible, given strong net cash post-IPO and the fractured digital monetization landscape.

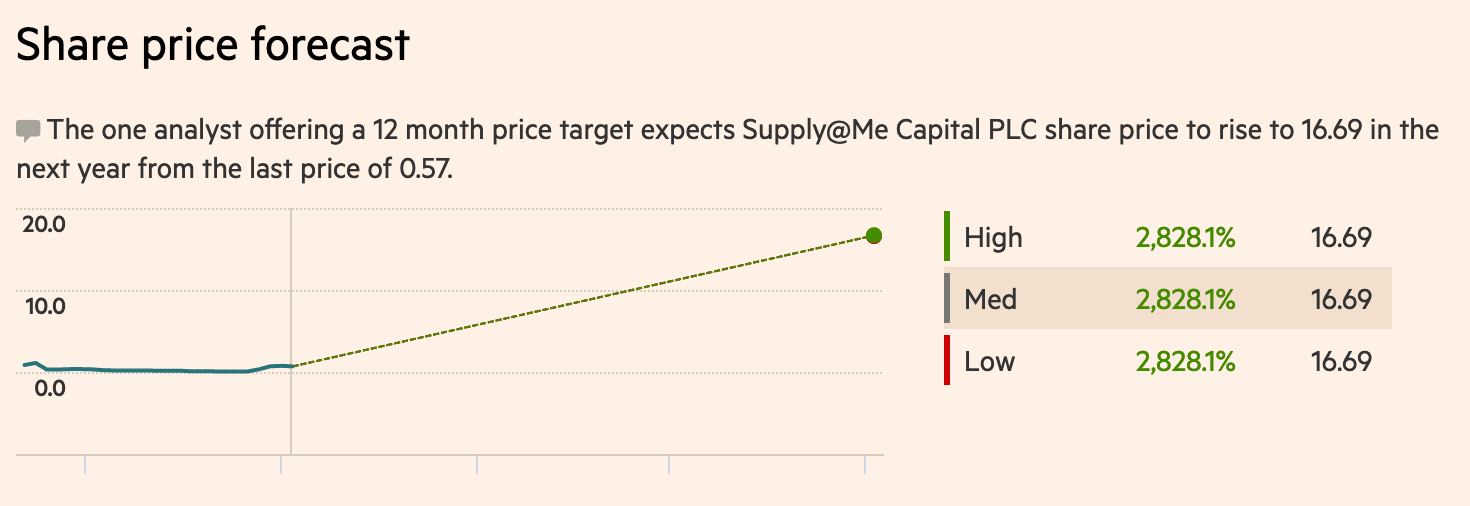

Analysts are beginning to pick up fintechs that are braced to ride over market headwinds as regulatory forces are loosened to help the global economy recover. We’d expect SYME to capitalize on the difficulties faced by companies who are sitting on stock and unable to free up liquidity in order to advance or push through the expected dip. Of the AIM’s standout performers this year, it is expected SYME will further enhance its reputation through 2021, with picks in the £16.00-£17.00 range.

Data: Financial Times

Multiple opportunities awaiting

Brexit and Covid headwinds are expected to make trading in the UK a once-in-a-generation opportunity as wild swings are predicted from both the No-Deal tariff and currency hits.

The expectation of reduced regulatory burdens and relief for start-ups, along with other business aid is high; the City of London and its strong pool of financial services firms will be open for business and looking for quick wins in markets beyond its doorstep in the wake of the split with the European Union. We believe the expected influx of foreign multinationals drawn by tax cuts and the subsequent inflows of international brands, technology, and services will further boost the global appeal of SYME’s solution.

Similar opportunities are apparent in the US and the ME, where the lack of flexible, rapid monetization platforms open to business offers a huge incentive for first-movers. Appetite for securitized funding is particularly high in post-recession economies, and unlikely to be affected by forthcoming elections and potential changes of government.

For latest news you can follow us on our Twitter Profile.

Leave a Reply